This portal is designed to present helpful information for clients.

Helpful Links

Government Resources

Internal Revenue Service (IRS)

IRS Free filing help for seniors if you make less than $69,000

California Board of Equalization

California Employment Development Department

California Franchise Tax Board

Employee Forms

W4: Employee’s Withholding Allowance

I9: Employment Eligibility Verification

Hiring Incentives to Restore Employment Act (HIRE) Employee Affidavit

Miscellaneous Tax Forms

Helpful Associations

We have found the following references to be very helpful.

FINANCIAL ADVISORS

PAYROLL SPECIALIST

Alan Brodie Associates

Financial advisor for retirement plans, investments and insurance

Alan Brodie, CFP, CLU

Financial Advisor, LPL Financial

1601 Dove Street, Suite 260 • Newport Beach, CA 92660-2427

949-612-6335 Telephone • alan.brodie@lpl.com

Securities offered through LPL Financial. Member FINRA/SIPC

BEN GOMEZ

Paychex Inc. | Business Consultant

1535 Scenic Ave, Ste 100

Costa Mesa, CA 92626

C: (949) 697-4022

E: bgomez1@paychex.com

OTHER

BILL SPANIEL

Public Relations Manager

California Society of CPAs / CalCPA Institute

330 N. Brand, #710

Glendale, CA 91203

Ph: 818.546.3552 / 800.922.5272

Fax: 818.246.4017

bill.spaniel@calcpa.org

www.calcpa.org

Twitter: @billspaniel

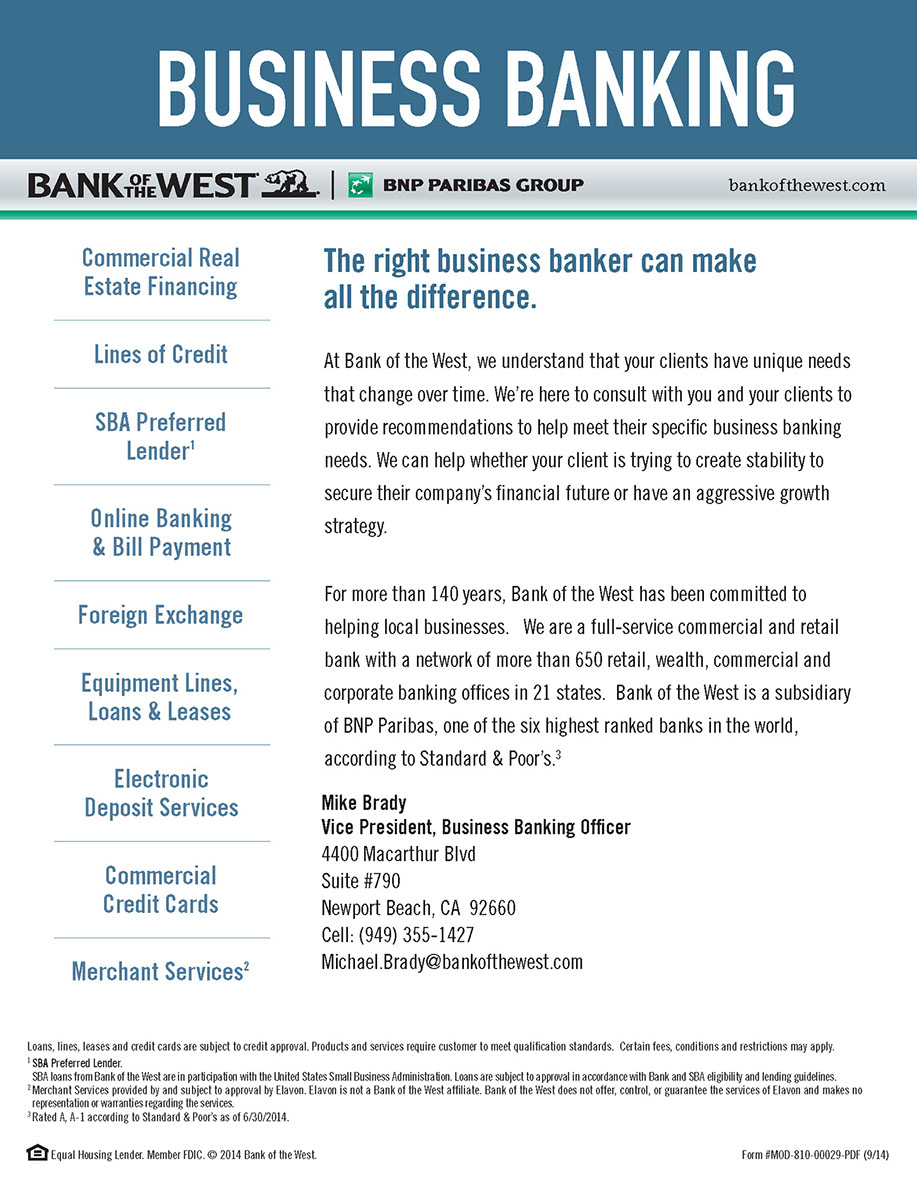

BANKING

Please note that the 15th filing deadline may move to the following business day if it falls on a weekend or holiday.

January 18th-4th quarter personal estimated tax payments(for prior tax year)

1st day to file 2019 returns (in Jan 2020) January 27, 2020.

February 1st, W-2 and 1099’s due to recipients

February 29th-W-2 and 1099 copies due to Social Security Administration and Internal Revenue Service

March 15th-Partnership/LLC (starting in 2017-for 2016 returns)-or extensions. Corporate tax returns (or extensions)

Important Dates & Alerts

April 15th-Individual tax returns (or extensions), CA corporate minimum estimated tax payment, 1st quarter personal estimated tax payments, Partnership/LLC returns (or extensions) for 2019 tax year, Trust returns (or extensions)

May 9th-CA Counties Business Personal Property Tax Returns

May 15th-Non-Profit Returns (for calendar year charities)

June 15th-CA LLC estimated fee (for current tax year), 2nd quarter personal estimated tax payment, 2nd quarter CA corporate estimated tax payment

September 15th-Partnership/LLC (on extension), Corporate tax returns (on extension), Trust tax returns (on extension), 3rd quarter personal estimated tax payments, 3rd quarter CA corporate estimated tax payment

September 30th-Trust returns (on extension)-starting in 2017-for 2016 returns

October 17th-Individual tax returns (on extension)

December 15th-4th quarter CA corporate estimated tax payment

Tax Tips

Here are some of the tax reform videos taxpayers can watch on their computer or on their smartphone when they’re on the go.

IRS Video Portal

The IRS produces and posts videos to post on the Video Portal. These videos can help individual and business taxpayers better understand how the tax reform law affects them and their taxes.

Tax Reform Basics for the Qualified Business Income Deduction, 199A

This webinar provides an overview of who will be eligible for the new tax reform provisions of the Qualified Business Income Deduction under Section 199A. It also shows calculations and basics for reporting.

Tax Reform Basics for Employers

This provides an overview of tax reform changes for employers. Topics covered include changes to employer credit for family and medical leave, employee achievement awards, and qualified transportation fringe benefits.

Tax Reform Basics for Individuals and Families

Addresses tax reform changes that affect individual taxpayers. Topics include standard deductions, personal exemptions, itemized deductions, and the child tax credit.

Understanding How to Use the IRS Withholding Calculator to Check & Correct Withholding

This video explains why many taxpayers may need to change their withholding. It also helps tax professionals understand how to use the IRS withholding calculator to help taxpayers change their withholding.

IRS YouTube Channel

These videos are all in English, with several also being offered in Spanish and American Sign Language.

Paycheck Checkup: English

Taxpayers can watch this video to find out why they should do a Paycheck Checkup after tax reform legislation changed how much tax is taken out of individuals’ paychecks.

IRS Withholding Calculator Tips: English

This video gives taxpayers tips for using the calculator, including what documents to have on hand before starting their Paycheck Checkup.

Paid Family and Medical Leave: English

If employers provide paid family and medical leave for their employees, they may be eligible for a tax credit. This video has more information about this credit.

The habit of saving is itself an education; it fosters every virtue, teaches self-denial, cultivates the sense of order, trains to forethought, and so broadens the mind.

― T. T. Munger

© 2023 Janet Lee Krochman, CPA / All Rights Reserved

(714) 325-5518

Meeting by appointment only

jkrochman@jlkcpa.com

Janet Lee Krochman, CPA

2973 Harbor Blvd., No. 644

Costa Mesa, CA 92626